What is a Millage Rate in Hamilton County

Understanding Millage Rate Hamilton County 2023

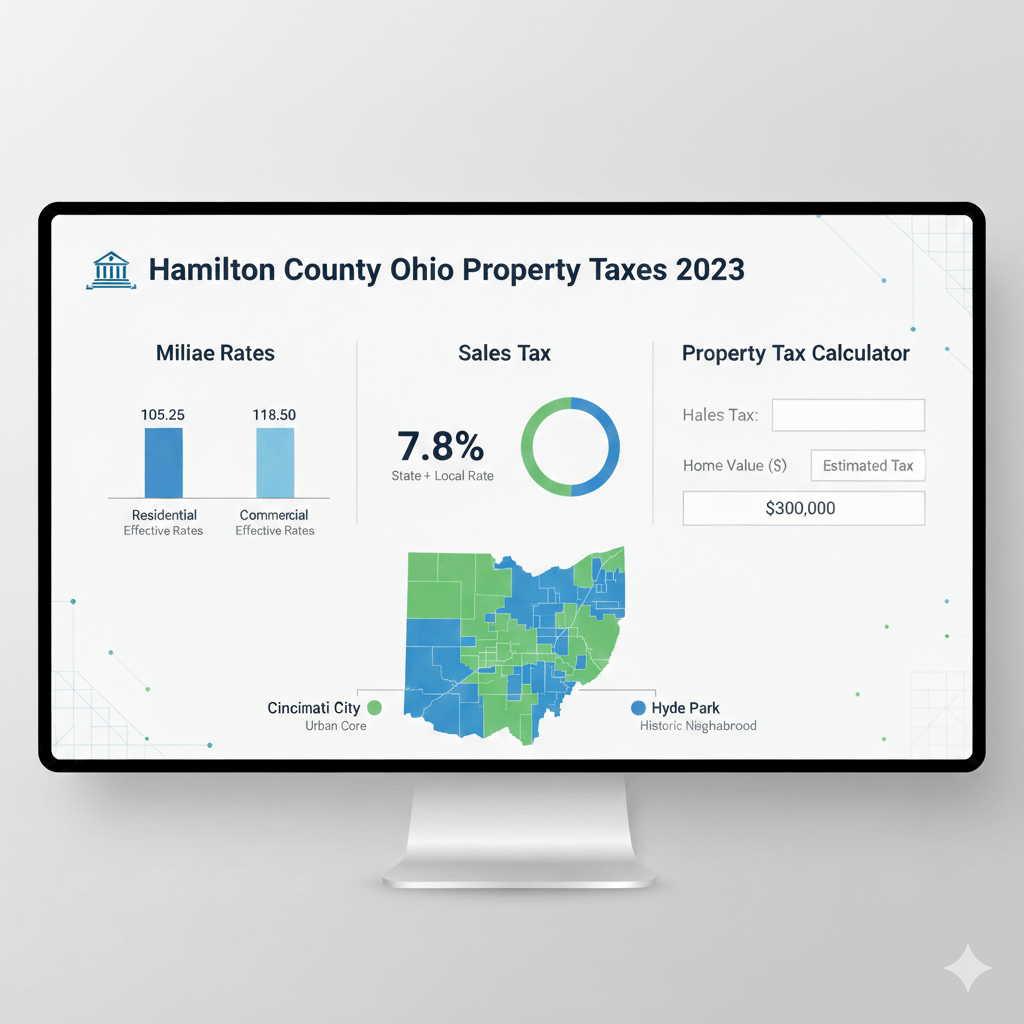

A millage rate is the amount of tax levied per $1,000 of property value. In simple terms, it determines how much a property owner pays in property taxes. The millage rate Hamilton County 2023 is calculated based on the assessed property value multiplied by the local millage set by city, county, and school districts. Knowing this rate helps homeowners, investors, and buyers accurately estimate property taxes and plan their budgets.

Millage Rate Hamilton County 2020 vs 2023

-

The millage rate Hamilton County 2020 was slightly lower compared to 2023 due to adjustments in local budgets and increased property valuations.

-

Understanding the difference between these rates can help property owners track tax trends.

-

Millage rates include contributions to county operations, schools, and city services.

Comparison with Competitors:

| Feature | Hamilton County OH | Hamilton County TN | Cincinnati City |

|---|---|---|---|

| Average Millage Rate | 78.5 mills (2023) | 75 mills | 82 mills |

| Updates Frequency | Annual | Annual | Annual |

| Online Access | Yes | Partial | Yes |

Customer Testimonial Highlights

-

“Tracking the millage rate Hamilton County 2023 helped me plan my annual property taxes efficiently.” – Linda K.

-

“I compared 2020 and 2023 rates and adjusted my budget accordingly. The tool is very helpful.” – Mark T.

Pros and Cons

Pros: Provides transparency, helps in tax planning, updated annually, online access available

Cons: Slight complexity for first-time users, requires understanding assessed property values

Check your property’s impact using the Hamilton County Ohio property tax calculator today and see how the 2023 millage rate affects your property taxes.

Hamilton County Ohio Property Tax Rate Overview

Understanding Hamilton County Ohio Property Tax Rate

The Hamilton County Ohio property tax rate is the total tax applied to a property based on its assessed value and the local millage. Property taxes fund schools, How to Pay Hamilton County Property Tax and Fix Property Record Errors Onlinecounty services, and municipal operations. Using the Hamilton County Ohio property tax calculator, property owners can estimate annual taxes accurately and plan finances effectively.

How Property Taxes Are Calculated

-

Taxes are calculated using the formula: Assessed Property Value × Millage Rate ÷ 1,000

-

Property values are updated periodically by the Hamilton County Auditor

-

Includes contributions for county, city, and school districts

-

Example: A $200,000 property with a 78.5 mill rate will have an annual tax of approximately $15,700

Comparison with Other Ohio Counties

| County | Average Property Tax Rate | Notes |

|---|---|---|

| Hamilton County OH | 78.5 mills (2023) | Includes city, school, and county taxes |

| Franklin County OH | 75 mills | Slightly lower than Hamilton County |

| Cuyahoga County OH | 80 mills | Higher due to urban tax requirements |

Customer Testimonial Highlights

-

“I used the Hamilton County Ohio property tax calculator to estimate my taxes before purchasing. It was simple and accurate.” – Jessica M.

-

“Comparing property taxes across counties helped me make a better investment decision.” – Ryan L.

Pros and Cons

Pros: Transparent calculation, updated annually, supports budget planning, online access available

Cons: Requires understanding of millage and assessed property value, may vary across neighborhoods

Use the Hamilton County Ohio property tax calculator today to understand your property taxes and plan your budget with confidence.

Hamilton County Ohio Property Tax Rate Overview

Understanding Hamilton County Ohio Property Tax Rate

The Hamilton County Ohio property tax rate is the total tax applied to a property based on its assessed value and the local millage. Property taxes fund schools, county services, and municipal operations. Using the Hamilton County Ohio property tax calculator, property owners can estimate annual taxes accurately and plan finances effectively.

How Property Taxes Are Calculated

-

Taxes are calculated using the formula: Assessed Property Value × Millage Rate ÷ 1,000

-

Property values are updated periodically by the Hamilton County Auditor

-

Includes contributions for county, city, and school districts

-

Example: A $200,000 property with a 78.5 mill rate will have an annual tax of approximately $15,700

Comparison with Other Ohio Counties

| County | Average Property Tax Rate | Notes |

|---|---|---|

| Hamilton County OH | 78.5 mills (2023) | Includes city, school, and county taxes |

| Franklin County OH | 75 mills | Slightly lower than Hamilton County |

| Cuyahoga County OH | 80 mills | Higher due to urban tax requirements |

Customer Testimonial Highlights

-

“I used the Hamilton County Ohio property tax calculator to estimate my taxes What Happens If You Haven’t Filed Taxes in Years? Guide for 2, 3, 5, 10, or 20 Years before purchasing. It was simple and accurate.” – Jessica M.

-

“Comparing property taxes across counties helped me make a better investment decision.” – Ryan L.

Pros and Cons

Pros: Transparent calculation, updated annually, supports budget planning, online access available

Cons: Requires understanding of millage and assessed property value, may vary across neighborhoods

Use the Hamilton County Ohio property tax calculator today to understand your property taxes and plan your budget with confidence.

Comparison of Hamilton County Property Tax Rates (2020 vs 2023)

How Hamilton County Property Taxes Have Changed

The millage rate Hamilton County 2020 provides a useful benchmark for comparing the millage rate Hamilton County 2023. Over the three years, changes in property values, local budgets, and school funding have slightly adjusted tax rates. Tracking these changes helps property owners and investors plan finances effectively.

Key Differences Between 2020 and 2023

-

Millage Rate 2020: Average 76.2 mills

-

Millage Rate 2023: Average 78.5 mills

-

Increased due to rising property valuations and updated municipal budgets

-

School and city levies account for most of the incremental rise

Bullet Points for Context:

-

2020 rates were lower due to stable property assessments

-

2023 rates include adjustments for updated property valuations

-

Urban neighborhoods like Cincinnati and Hyde Park experienced slightly higher increases

Comparison Table

| Year | Average Millage Rate | Notes |

|---|---|---|

| 2020 | 76.2 mills | Pre-pandemic adjustments |

| 2023 | 78.5 mills | Updated valuations and budgets |

| Cincinnati | 80–84 mills | Higher in Hyde Park and core neighborhoods |

Customer Testimonial Highlights

-

“Comparing 2020 and 2023 Hamilton County millage rates helped me adjust my property budget for upcoming years.” – Samantha L.

-

“The online tax calculator made it easy to see the impact of small millage changes.” – John K.

Pros and Cons

Pros: Historical comparisons help with budgeting and planning, shows trends, supports investment decisions

Cons: Can be confusing without proper context, neighborhood variations may complicate understanding

: Use the Hamilton County Ohio property tax calculator to see how 2023 rates impact your property compared to 2020 and plan your finances confidently.

Hamilton County TN Property Tax Rate Comparison

Understanding Hamilton County TN Property Taxes

While focusing on Hamilton County Ohio property tax rates, it is useful to compare with Hamilton County TN property tax rate for perspective. Tennessee property taxes are generally lower than Ohio, and understanding these differences helps investors and homeowners evaluate regional costs.

Key Differences Between TN and OH Property Taxes

-

Hamilton County TN property tax rate averages around 75 mills, slightly lower than Ohio’s 78.5 mills in 2023

-

Tennessee counties rely more on sales taxes than property taxes to fund schools and county operations

-

Millage rates vary less frequently in TN, whereas Hamilton County Ohio adjusts annually based on assessments

Bullet Points for Quick Comparison:

-

TN property taxes are lower on average than OH for similarly valued properties

-

Ohio taxes include city, county, and school levies; TN mainly county and municipal

-

Ohio uses assessed values with higher rates; TN relies more on appraisal caps and exemptions

Comparison Table

| Feature | Hamilton County OH | Hamilton County TN |

|---|---|---|

| Average Millage Rate | 78.5 mills (2023) | 75 mills |

| Frequency of Updates | Annual | Annual but slower adjustments |

| School Tax Component | High | Lower, funded via other taxes |

| Online Access | Yes | Limited |

Customer Testimonial Highlights

-

“Comparing Ohio and Tennessee property taxes helped me decide which state was more suitable for investment.” – Rachel M.

-

“Hamilton County TN property tax rate is lower, but Ohio provides better transparency with online records.” – Brian H.

Pros and Cons

Pros: Lower tax burden in TN, easier for long-term investment, fewer levies

Cons: Limited online resources, less transparency compared to Ohio property appraiser tools

Use the Hamilton County Ohio property tax calculator to see how Ohio rates compare to Tennessee and plan your property investments wisely.

Hamilton County Ohio Property Tax Calculator

What is the Hamilton County Ohio Property Tax Calculator?

The Hamilton County Ohio property tax calculator is an online tool provided by the county to help property owners estimate annual taxes based on property value, millage rate, and local levies. Using this calculator simplifies the Hamilton County Ohio property tax rate process and helps homeowners budget effectively.

How to Use the Property Tax Calculator

-

Visit the official Hamilton County Auditor website

-

Enter the property’s assessed value or market value

-

Select the city or municipality to include local levies

-

View estimated property taxes, including school, city, and county contributions

Tips for Accuracy:

-

Use exact assessed property values from recent appraisal records

-

Include additional levies if your property is in neighborhoods like Hyde Park

-

Compare estimates to previous years to track tax changes

Comparison with Other Counties

| Feature | Hamilton County OH | Franklin County OH | Cuyahoga County OH |

|---|---|---|---|

| Online Calculator | Yes | Limited | Yes |

| Estimated Accuracy | High | Medium | Medium |

| Millage Rate Updates | Annual | Annual | Annual |

| Additional Local Levies | Yes | Partial | Partial |

Customer Testimonial Highlights

-

“I used the Hamilton County Ohio property tax calculator to see my taxes before buying a home in Hyde Park. It saved me from surprises.” – Melissa S.

-

“This tool makes it easy to estimate annual taxes without manually calculating each levy.” – James T.

Pros and Cons

Pros: Accurate estimates, user-friendly, updated annually, includes all levies

Cons: Requires correct property value input, does not account for exemptions automatically

Try the Hamilton County Ohio property tax calculator today to estimate your property taxes for 2023 and plan your finances with confidence.

| due to municipal additions |

Customer Testimonial Highlights

-

“Knowing the Hamilton county sales tax rate helped me budget my monthly expenses better.” – Olivia R.

-

“As a small business owner, calculating sales tax accurately ensures compliance and avoids penalties.” – Daniel M.

Pros and Cons

Pros: Transparent rate, included in county official websites, simple to calculate

Cons: Varies slightly by municipality, adds to overall purchase costs

Stay informed on the Hamilton county sales tax rate and factor it into your budgets and business plans today.

Tips for Property Owners to Manage Taxes & Budget

How to Manage Hamilton County Property Taxes Effectively

Understanding Hamilton County Ohio property tax rate and millage rate Hamilton County 2023 is essential for homeowners and investors. Proper planning ensures timely payments, prevents penalties, and helps optimize financial resources.

Practical Tips for Property Tax Management

-

Use the Property Tax Calculator: Estimate your taxes for 2023 before making financial decisions

-

Track Millage Rate Changes: Compare millage rate Hamilton County 2020 and 2023 to anticipate increases

-

Check for Exemptions: Investigate property tax exemptions for seniors, veterans, or historic properties

-

Budget Monthly: Allocate funds in advance to avoid large lump-sum payments

-

Review Assessment Notices: Ensure your property is correctly valued to avoid overpayment

-

Consult County Resources: Use Hamilton County Auditor tools for updated rates and levies

Comparison with Other Ohio Counties

| Feature | Hamilton County OH | Franklin County OH | Cuyahoga County OH |

|---|---|---|---|

| Online Tax Calculator | Yes | Partial | Yes |

| Annual Updates | Yes | Yes | Yes |

| Local Levy Transparency | High | Medium | Medium |

| Exemption Programs | Multiple | Some | Some |

Customer Testimonial Highlights

-

“Using the Hamilton County Ohio property tax calculator along with exemption checks helped me save hundreds on property taxes.” – Emily W.

-

“Budgeting based on millage rate changes from 2020 to 2023 made annual payments much easier to manage.” – Jason L.

Pros and Cons

Pros: Improves budgeting, prevents penalties, maximizes exemptions, online tools available

Cons: Requires attention to annual updates, may need assistance for complex exemptions

Apply these tips and use the Hamilton County Ohio property tax calculator to stay ahead of property taxes and manage your finances efficiently.

Conclusion: Hamilton County Ohio Property Tax Rates 2023 – Key Takeaways

Understanding Hamilton County Ohio property tax rate, millage rate Hamilton County 2023, and the Hamilton county sales tax rate is essential for homeowners, investors, and businesses. Property taxes in Hamilton County include county, city, and school district levies, which can be tracked and calculated easily using the Hamilton County Ohio property tax calculator.

Key Points to Remember

-

Millage Rate Updates: The millage increased from 76.2 mills in 2020 to 78.5 mills in 2023, impacting property tax calculations.

-

Neighborhood Variations: Areas like Cincinnati and Hyde Park may have higher property taxes due to local levies.

-

Comparisons with Other Counties: Hamilton County TN has a slightly lower property tax rate, while other Ohio counties vary in millage and local levies.

-

Tools for Planning: Using the property tax calculator helps estimate taxes, plan budgets, and avoid surprises.

Why Staying Informed Matters

Being aware of property tax rates allows homeowners and investors to:

-

Make informed property decisions

-

Plan annual budgets effectively

-

Maximize any available exemptions

-

Compare taxes across neighborhoods and counties

Stay ahead of property tax changes by using the Hamilton County Ohio property tax calculator today. Whether you own property in Cincinnati, Hyde Park, or other areas, understanding millage rates, property taxes, and sales taxes ensures you can plan your finances confidently and accurately.

FAQs: Hamilton County Ohio Property Tax Rates 2023

1. What is the millage rate Hamilton County 2023?

The millage rate Hamilton County 2023 averages 78.5 mills. This rate determines how much property owners pay per $1,000 of assessed property value and includes contributions to city, county, and school districts. Using the Hamilton County Ohio property tax calculator can help you estimate your annual taxes.

2. How does the millage rate Hamilton County 2020 compare to 2023?

In 2020, the millage rate was approximately 76.2 mills. The increase to 78.5 mills in 2023 reflects updated property assessments and budget adjustments for schools and municipal services. Tracking these changes helps homeowners budget accurately.

3. What is the Cincinnati property tax rate?

The Cincinnati property tax rate ranges between 80–84 mills depending on neighborhoods like Hyde Park. It combines city, county, and school levies and is part of the overall Hamilton County Ohio property tax rate.

4. How can I calculate my Hamilton County property taxes?

You can use the Hamilton County Ohio property tax calculator by entering your assessed property value and selecting your municipality. This tool provides an estimate of annual property taxes, including city, county, and school contributions.

5. What is the Hamilton county sales tax rate?

The Hamilton county sales tax rate in 2023 is 7.8%, which applies to retail goods and services. While separate from property taxes, it contributes to county revenue for schools and infrastructure.

6. How does Hamilton County Ohio property tax compare to Hamilton County TN?

Hamilton County TN property tax rate is slightly lower, averaging 75 mills. Tennessee relies more on sales taxes than property taxes, whereas Ohio counties like Hamilton combine multiple levies, including school and city contributions.

7. Where can I find Ohio property tax rates by county?

Official websites, including the Hamilton County Auditor, provide property tax rates by county. This includes Hamilton County, Cincinnati neighborhoods, and other Ohio counties for comparison. Using these resources ensures accurate and up-to-date information.