Introduction to Hamilton County Bonds

Understanding Hamilton County Bonds

When someone is arrested in Hamilton County, Ohio, the court may set a bail amount to ensure the defendant appears for all court proceedings. For many, paying the full bail amount is not feasible. This is where bail bonds: post bail options and Hamilton County bond services become crucial. Bonds serve as a financial guarantee to the court that the defendant will comply with legal obligations.

Importance of Hamilton County Bonds

-

Provide immediate release from Hamilton County Jail while the case is pending.

-

Reduce jail overcrowding and ensure proper legal procedure.

-

Allow families to manage financial responsibilities effectively through licensed agents.

Key Bond Types

-

Active Bonds: Bonds currently in effect, ensuring defendants comply with court appearances.

-

Inactive Bonds: Bonds that are closed or forfeited.

-

Refundable Bonds: Certain bonds may be refunded once case obligations are fulfilled.

Comparison with Competitors

While some counties require full bail payment directly to the court, Hamilton County offers options to post bail using a licensed agent. This allows families to pay a fraction of the bail amount instead of tying up large sums of cash.

| Feature | Full Bail Payment | Hamilton County Bonds |

|---|---|---|

| Cost | Full bail upfront | Partial payment through licensed agents |

| Speed | May delay release | Quick release via bond services |

| Refund | Court-managed | Some bonds refundable depending on conditions |

| Assistance | Minimal guidance | Agent support and EMU coordination |

Customer Testimonial Highlight

One resident shared: “Using a Hamilton County bond agent allowed my brother to be released quickly. The agent explained how bail bonds: post bail works and guided us through the refund process. It made a stressful situation much easier.”

Understanding Hamilton County bonds and how to post bail effectively is critical for anyone navigating the legal system. Contact a licensed Hamilton County bond agent today to ensure timely release, compliance with all requirements, and peace of mind.

What Are Hamilton County Bonds?

Definition of Hamilton County Bonds

A Hamilton County bond is a financial agreement used to secure the temporary release of a defendant from Hamilton County Jail. When a court sets bail, it ensures that the defendant will attend all scheduled hearings. If the defendant cannot pay the full bail, a licensed bond agent can assist in posting a bond, often allowing families to pay only a fraction of the total amount. This process is commonly referred to as bail bonds: post bail.

Types of Hamilton County Bonds

-

Cash Bond: Full bail amount paid directly to the court.

-

Surety Bond: Payment arranged through a licensed bond agent, typically 10% of the total bail.

-

Property Bond: Real estate or other assets used as collateral to secure the bond.

-

Active Bond: A bond currently ensuring compliance with court orders.

How Hamilton County Bonds Work

-

Defendant is arrested and bail is set by the court.

-

Families contact a licensed Hamilton County bond agent.

-

Bond agent posts the bond, allowing the defendant to be released from jail.

-

Defendant must comply with all court appearances to avoid forfeiture.

-

Certain bonds may be eligible for a Hamilton County bond refund depending on the case outcome.

Comparison: Hamilton County Bonds vs Direct Bail

| Feature | Direct Bail Payment | Hamilton County Bonds |

|---|---|---|

| Upfront Cost | Full bail amount | Typically 10% fee via agent |

| Speed | Depends on funds availability | Faster through licensed agents |

| Refund | Court-managed, full refund possible | Refund may include collateral; agent fee non-refundable |

| Support | Minimal guidance | Agent provides guidance, EMU coordination |

Pros and Cons

Pros

-

Faster release from Hamilton County Jail

-

Reduced financial burden through partial payment

-

Expert guidance for meeting all legal obligations

Cons

-

Non-refundable agent fees

-

Collateral may be required

-

Missteps can result in bond forfeiture

Customer Testimonial Highlight

One client shared: “We didn’t have enough to pay full bail, but using a Hamilton County bond agent allowed my brother to be released the same day. The agent explained bail bonds: post bail and assisted with all paperwork. It was a huge relief.”

Call-to-Action

Understanding what Hamilton County bonds are is essential for timely and efficient release from jail. Contact a licensed bond agent to post bail, ensure compliance with requirements, and explore options for bond refunds.

Hamilton County Active Bonds

What Are Active Bonds in Hamilton County?

Hamilton County active bonds are bonds that are currently in effect and ensure that a defendant complies with court requirements. These bonds are monitored to confirm attendance at hearings and adherence to any conditions set by the court or EMU (Electronic Monitoring Unit). Understanding active bonds is crucial for families and legal representatives to track release status and prevent forfeiture.

How to Identify an Active Bond

-

Check the bond number: Each bond has a unique Hamilton County bond number for identification.

-

Online records: Hamilton County provides online tools to check the status of active bonds.

-

Contact EMU: For electronically monitored cases, the Hamilton County EMU phone number can be used for updates.

Key Features of Active Bonds

-

Legally binding agreement ensuring court appearance.

-

May involve conditions such as electronic monitoring or reporting requirements.

-

Helps reduce jail overcrowding while maintaining legal accountability.

Comparison: Active Bonds vs Inactive Bonds

| Feature | Active Bonds | Inactive Bonds |

|---|---|---|

| Status | Currently in effect | Closed or forfeited |

| Court Compliance | Required | Not applicable |

| Refund Eligibility | Possible if conditions met | Not applicable |

| Monitoring | Active monitoring through EMU or agents | No monitoring |

Pros and Cons

Pros

-

Provides immediate release from Hamilton County Jail

-

Offers structured oversight through EMU or agents

-

Ensures defendants remain compliant with court orders

Cons

-

Requires strict adherence to court conditions

-

Missed hearings can lead to bond forfeiture

-

Some cases require collateral or additional monitoring fees

Customer Testimonial Highlight

One family shared: “We tracked my cousin’s Hamilton County active bond online and stayed updated through the EMU. The agent also explained how bail bonds: post bail works. The process was clear, and he was released without issues.”

Call-to-Action

Understanding Hamilton County active bonds is essential for staying informed and avoiding legal complications. Contact a licensed bond agent today to manage your bond, track compliance, and ensure smooth release from jail.

Hamilton County Bond Refunds

What is a Hamilton County Bond Refund?

A Hamilton County bond refund is the return of funds or collateral used to post a bond after a defendant has met all court obligations. Many families are unaware that while some funds can be refunded, the agent’s service fee for bail bonds: post bail is typically non-refundable. Understanding refund policies helps prevent surprises and ensures financial planning.

When Are Bond Refunds Available?

-

Case Completion: Refunds are processed after all court appearances are satisfied.

-

Collateral Return: If collateral such as property or cash was used, it may be returned once the case closes.

-

Agent Fees: The 10% fee paid to the bail bond agent is generally non-refundable.

How to Request a Refund

-

Confirm that the defendant attended all scheduled court dates.

-

Contact the bond agent who posted the Hamilton County bond.

-

Submit any required documents proving compliance.

-

Receive collateral back once the agent verifies completion.

Comparison: Direct Bail Refund vs Bond Refund

| Feature | Direct Bail Payment | Hamilton County Bond Refund |

|---|---|---|

| Refund Amount | Full bail refunded if conditions met | Collateral refunded; agent fee retained |

| Processing Time | May take days to weeks | Usually faster with agent handling |

| Financial Risk | Lower if cash paid directly | Risk of losing collateral if obligations missed |

| Guidance | Minimal | Agent provides refund guidance |

Pros and Cons

Pros

-

Collateral can be recovered after case completion

-

Agents assist in handling the refund process

-

Ensures timely release while managing financial responsibilities

Cons

-

Agent fees are non-refundable

-

Refund may be delayed if court compliance is incomplete

-

Collateral risk if the defendant misses hearings

Customer Testimonial Highlight

A client shared: “We used a Hamilton County bond to release my brother. After all hearings, our collateral was returned, and the agent explained everything about bail bonds: post bail and the refund process. It made the experience much less stressful.”

Call-to-Action

Knowing the rules for Hamilton County bond refunds is essential for families. Contact a licensed bond agent to ensure proper handling of collateral, compliance with court rules, and understanding of bail bonds: post bail procedures.

Hamilton County EMU Contacts & Phone Numbers

What is Hamilton County EMU?

The Electronic Monitoring Unit (EMU) in Hamilton County monitors defendants released on bond to ensure compliance with court orders. EMU plays a key role in the bond process by tracking active bonds, verifying attendance at hearings, and enforcing conditions set by the court. Knowing the Hamilton County EMU phone number and contact process is essential for defendants, families, and attorneys.

Key Responsibilities of EMU

-

Monitor defendants with electronic devices or ankle monitors.

-

Maintain records of compliance for Hamilton County active bonds.

-

Communicate with bond agents and the court regarding bond status.

-

Assist families in understanding bail bonds: post bail requirements.

How to Contact EMU

-

Hamilton County EMU Phone Number: [Insert official number from Hamilton County site]

-

Call EMU for:

-

Checking the status of a monitored bond

-

Reporting issues or updates regarding a defendant

-

Clarifying bond conditions or requirements

-

Comparison: EMU Monitoring vs Standard Bond

| Feature | Standard Bond | EMU Monitored Bond |

|---|---|---|

| Oversight | Limited | Continuous monitoring via electronic devices |

| Compliance | Relies on court reporting | Real-time compliance verification |

| Risk | Defendant may miss court | Violations immediately reported to court |

| Support | Minimal | EMU guidance and agent coordination |

Pros and Cons

Pros

-

Ensures court compliance for active bonds

-

Reduces risk of bond forfeiture

-

Provides peace of mind for families

-

Allows defendants to remain out of jail while monitored

Cons

-

May require electronic monitoring devices

-

Additional fees could apply

-

Restrictions on movement and activities

Customer Testimonial Highlight

A client shared: “The Hamilton County EMU phone number was very helpful when we needed updates about my brother’s active bond. The agent explained how bail bonds: post bail work and how EMU monitoring ensures compliance. It made the process much easier.”

Stay informed about your Hamilton County active bond by contacting EMU directly. Ensure compliance with all court orders, monitor bond status, and coordinate with a licensed bond agent to manage bail bonds: post bail effectively.

Hamilton County Bond Numbers – How to Use Them

What is a Hamilton County Bond Number?

A Hamilton County bond number is a unique identifier assigned to each bond issued by the court. This number helps track the status of a bond, verify payments, and confirm compliance with all court requirements. Families and legal representatives often rely on bond numbers to manage bail bonds: post bail efficiently.

Importance of Bond Numbers

-

Track Hamilton County active bonds easily online.

-

Facilitate communication with the court, EMU, or bail bond agents.

-

Ensure proper identification when requesting a bond refund.

How to Use a Hamilton County Bond Number

-

Locate the Bond Number: Found on bond paperwork or provided by the bail bond agent.

-

Verify Status: Use the bond number on official Hamilton County websites or contact EMU.

-

Request Refunds: Provide the bond number to agents or the court when requesting a Hamilton County bond refund.

-

Coordinate with Agents: Use the number to track payments and compliance.

Comparison: Bond Number vs General Bond Information

| Feature | General Bond Info | Bond Number |

|---|---|---|

| Identification | Can be confusing | Unique and precise identifier |

| Tracking | Limited | Easy to track online or via EMU |

| Refunds | May require extra verification | Streamlines refund process |

| Agent Coordination | Less efficient | Simplifies agent communication |

Pros and Cons

Pros

-

Accurate tracking of active bonds

-

Quick access to status updates

-

Simplifies communication with EMU and agents

Cons

-

Requires proper documentation

-

Misplaced numbers can delay processing

-

Must be provided for all refund or compliance requests

Customer Testimonial Highlight

A client shared: “Having the Hamilton County bond number made it easy to track my brother’s bond. Our agent explained bail bonds: post bail and ensured all court and EMU requirements were met. Everything went smoothly.”

Always keep your Hamilton County bond number handy. Use it to verify active bonds, coordinate with a licensed agent, and request refunds efficiently. Proper use of bond numbers ensures smooth handling of all bail bonds: post bail procedures.

Hamilton County Jail and Bond Procedures

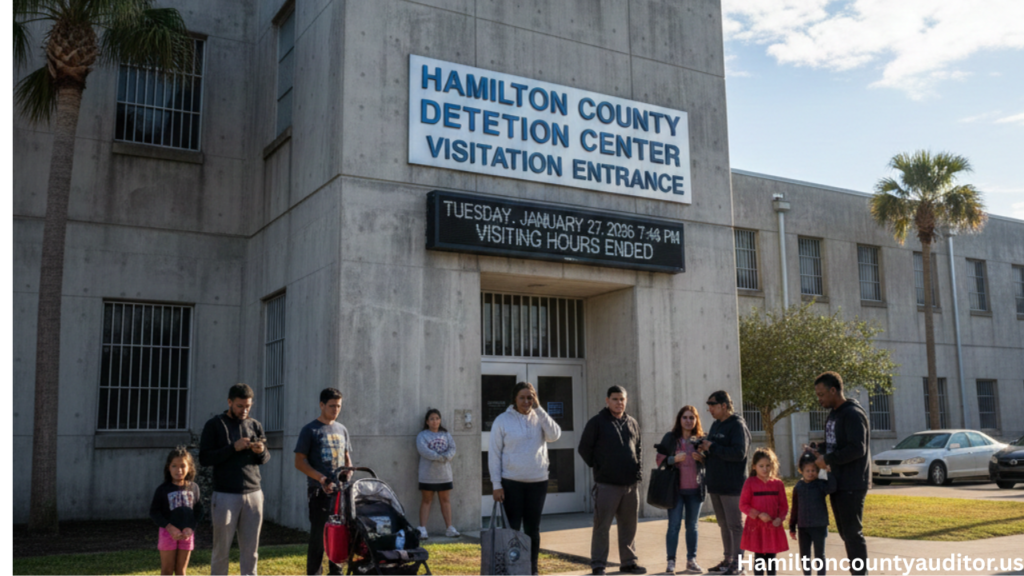

Overview of Hamilton County Jail

Hamilton County Jail houses individuals arrested in the county while they await trial or sentencing. For many, the option to post bail allows temporary release from jail. Understanding Hamilton County bond procedures is essential for families and defendants to navigate the system efficiently and ensure compliance.

How Bond Procedures Work at Hamilton County Jail

-

Arrest and Booking:

-

Defendant is processed at the jail.

-

Charges and bail amount are recorded.

-

-

Bail Determination:

-

Court sets bail based on the charges, criminal history, and flight risk.

-

Bail may be paid in full or through a licensed agent via bail bonds: post bail.

-

-

Posting Bail:

-

Payment of cash, bond fee, or collateral is submitted to the court or agent.

-

Defendant may be released once the bond is posted.

-

-

Monitoring and Compliance:

-

Some defendants may be assigned EMU (Electronic Monitoring Unit).

-

Court appearances must be attended to prevent bond forfeiture.

-

Comparison: Hamilton County Jail Bonds vs Direct Bail

| Feature | Direct Bail | Bail Bond via Agent |

|---|---|---|

| Upfront Payment | Full bail amount | 10% fee + collateral if required |

| Release Speed | Depends on funds availability | Faster through agent assistance |

| Monitoring | Standard court supervision | EMU or agent oversight possible |

| Refund | Full refund if bail paid directly | Collateral may be refunded; agent fee non-refundable |

Pros and Cons

Pros

-

Allows defendants to leave jail while awaiting trial

-

Provides structured compliance through EMU or agent support

-

Reduces financial burden with partial payments

Cons

-

Agent fees are non-refundable

-

Collateral may be required

-

Failure to comply can result in bond forfeiture and re-arrest

Customer Testimonial Highlight

A family noted: “Using a Hamilton County bond helped our son leave jail quickly. The agent explained bail bonds: post bail, coordinated with EMU, and ensured all court appearances were met. It simplified a stressful process.”

To navigate Hamilton County jail and bond procedures effectively, contact a licensed bond agent. Ensure timely release, compliance with court rules, and proper handling of bail bonds: post bail for a smooth legal process.

Pros and Cons of Using Hamilton County Bonds

Why Consider Using Hamilton County Bonds

Using a Hamilton County bond allows families to secure the release of a defendant from jail efficiently without paying the full bail amount. It combines financial flexibility, expert guidance, and legal compliance. Understanding the pros and cons helps in making informed decisions when posting bail.

Pros of Hamilton County Bonds

-

Faster Jail Release: Bonds allow defendants to leave Hamilton County Jail quickly while awaiting trial.

-

Reduced Financial Burden: Using bail bonds: post bail typically requires only 10% of the full bail amount.

-

Expert Guidance: Licensed agents manage paperwork, court filings, and EMU coordination.

-

Peace of Mind: Families can focus on legal proceedings rather than arranging large sums of cash.

Cons of Hamilton County Bonds

-

Non-Refundable Agent Fees: The 10% service fee is retained regardless of case outcome.

-

Collateral Risk: Assets may be required and forfeited if the defendant fails to comply.

-

Co-Signer Responsibility: Co-signers are legally accountable for defendant compliance.

-

Monitoring Restrictions: EMU-monitored defendants may face activity restrictions and additional fees.

Comparison: Hamilton County Bonds vs Direct Bail

| Feature | Direct Bail Payment | Hamilton County Bond |

|---|---|---|

| Cost | Full bail upfront | Only 10% fee + collateral if required |

| Speed | Depends on cash availability | Faster release through licensed agent |

| Risk | Less risk if bail refunded | Collateral may be forfeited if requirements missed |

| Support | Minimal guidance | Agent provides support and EMU coordination |

Customer Testimonial Highlight

One client shared: “We didn’t have enough to pay full bail, but using a Hamilton County bond made release possible the same day. The agent explained how bail bonds: post bail works and ensured all court requirements were met. It was a huge relief.”

Call-to-Action

Before posting bail, understand the pros and cons of using Hamilton County bonds. Contact a licensed bond agent to manage all requirements, coordinate with EMU, and ensure timely, compliant release from jail. Proper guidance makes the process smooth and stress-free.

Conclusion: Navigating Hamilton County Bonds Effectively

Understanding Hamilton County bonds is essential for anyone navigating the legal system in Ohio. Whether it’s learning how to post bail, tracking active bonds, requesting a bond refund, or contacting the EMU, knowing the processes helps ensure timely release and compliance with court rules.

Key takeaways include:

-

Hamilton County active bonds ensure that defendants follow all court obligations and can be monitored through EMU if required.

-

Hamilton County bond refunds are possible once all court appearances are completed, but agent fees for bail bonds: post bail are typically non-refundable.

-

Each bond has a Hamilton County bond number for identification, tracking, and communication with agents or the court.

-

Using a licensed agent provides guidance, faster release, and reduced financial stress compared to paying full bail directly.

-

Understanding the pros and cons of Hamilton County bonds helps families make informed decisions while managing responsibilities.

By working with a licensed agent and keeping track of bond numbers and EMU contacts, families can ensure that the defendant’s release is smooth, legal obligations are met, and potential financial or legal risks are minimized.

Final Call-to-Action

If you or a loved one needs assistance with posting bail in Hamilton County, contact a licensed bond agent today. They can help:

-

Post bail quickly using bail bonds: post bail

-

Track active bonds efficiently

-

Coordinate with EMU for compliance

-

Handle bond refund processes effectively

Proper knowledge and guidance about Hamilton County bonds allow families to stay informed, protect assets, and manage the legal process with confidence and peace of mind.

Frequently Asked Questions (FAQs)

1. What are Hamilton County bonds?

Hamilton County bonds are financial agreements used to secure the temporary release of a defendant from jail. They guarantee the court that the defendant will attend all scheduled hearings. Families often work with agents for bail bonds: post bail.

2. How can I check Hamilton County active bonds?

To check Hamilton County active bonds, use the court’s online bond database or contact a licensed bond agent. Active bonds ensure compliance and allow for real-time monitoring through EMU if applicable.

3. How does a Hamilton County bond refund work?

A Hamilton County bond refund is the return of collateral after the defendant meets all court obligations. While the refund may include cash or property used, the agent fee for bail bonds: post bail is typically non-refundable.

4. What is a Hamilton County bond number?

A Hamilton County bond number is a unique identifier assigned to each bond. It is used to track bond status, request refunds, and communicate with agents or the court. Keeping this number handy simplifies all bond-related processes.

5. How does EMU help with Hamilton County bonds?

The Electronic Monitoring Unit (EMU) tracks defendants released on bond, ensuring compliance with court orders. EMU coordinates with agents to monitor Hamilton County active bonds and helps families understand bail bonds: post bail requirements.

6. What are the steps to post bail in Hamilton County?

To post bail in Hamilton County:

-

Contact a licensed bond agent.

-

Provide the bond number and any collateral.

-

Pay the agent’s fee (usually 10% of the bail).

-

Ensure all court appearances are met to avoid forfeiture.

7. What is the difference between posting bail directly and using a Hamilton County bond?

Posting bail directly requires paying the full court-set amount upfront. Using a Hamilton County bond allows payment of only a percentage through a licensed agent, offers expert guidance, faster release, and may include EMU monitoring.