Introduction to St Lucie County Property Search & Tax Records

Why St Lucie County Property Search Matters

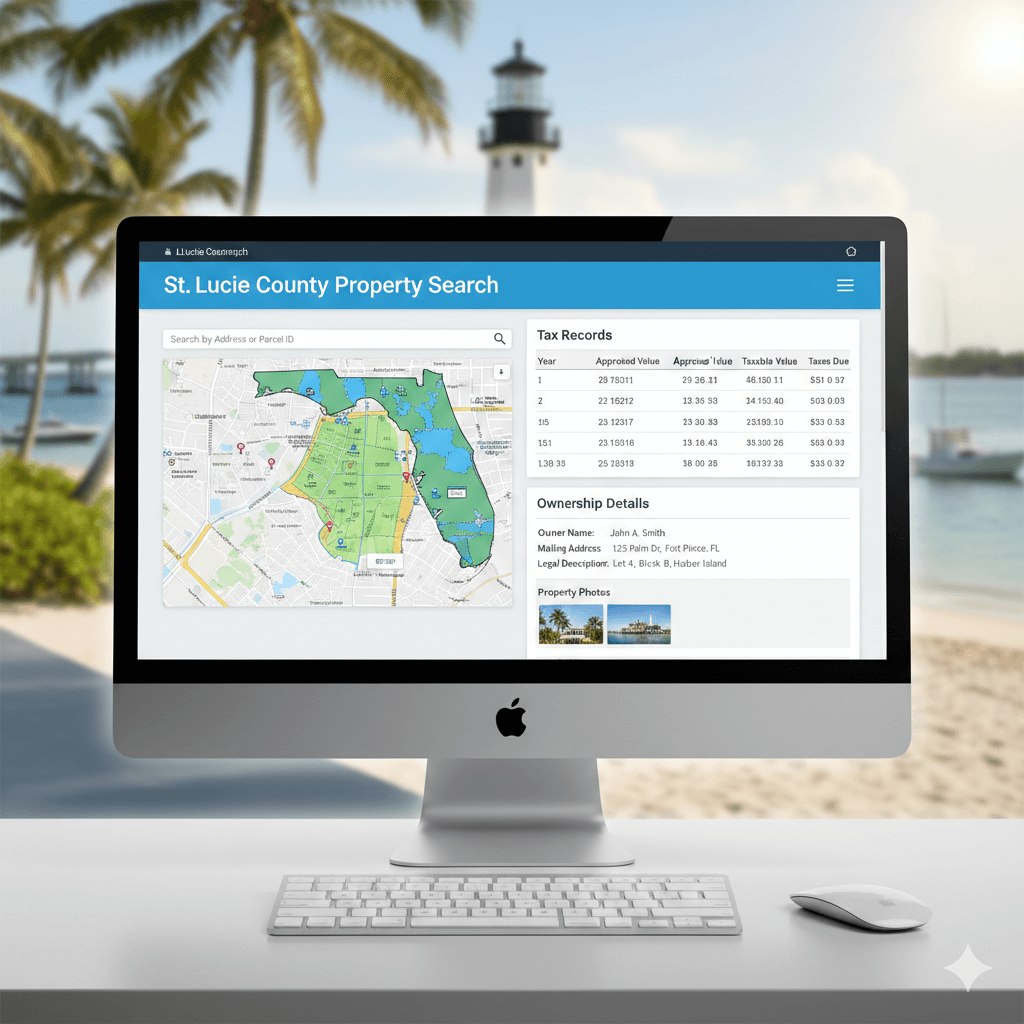

If you are buying, selling, investing, or reviewing property ownership in Florida, understanding how the St Lucie county property search system works is essential. Public access to property records ensures transparency, protects buyers, and helps property owners verify their tax responsibilities. Whether you are searching in Port St Lucie or reviewing nearby jurisdictions like the Martin County property appraiser office, accurate data is critical for financial decisions.

The St Lucie county property search portal allows users to review ownership records, parcel details, assessed values, and historical tax data. Many users also perform a Port St Lucie property search by name when they do not have a parcel number available.

What Information You Can Access

Through official databases, you can find:

-

Ownership history

-

Assessed and market value

-

Land and building details

-

Exemptions status

-

Port St Lucie Property Tax search results

-

Payment history via St Lucie County Tax Collector

-

St Lucie County official records including deeds and liens

Comparison with Competitors

When comparing St Lucie county property search tools with Martin County property appraiser systems, users often find:

-

Faster search filters in St Lucie

-

More detailed parcel breakdown

-

Easier navigation for St Lucie County property search by Address

-

Integrated tax lookup for St Lucie County Property Tax

Customer Testimonial Highlights

Many property owners report that using St Lucie County official records online saved time during closings and refinancing.

If you are planning a purchase or verifying tax details, start your St Lucie county property search today to access accurate and up-to-date public records.

How to Perform St Lucie County Property Search Step by Step

Complete Guide to St Lucie county property search

Performing a St Lucie county property search is simple when you follow the correct process. Whether you are verifying ownership, reviewing St Lucie County Property Tax records, or conducting due diligence before buying, the system is designed for public access.

Step 1 – Choose Your Search Method

You can search using:

-

Owner name for Port St Lucie property search by name

-

Full address for St Lucie County property search by Address

-

Parcel identification number

-

Legal description

Each method provides slightly different advantages depending on the information available.

Step 2 – Review Property Details

Once results appear, carefully check:

-

Owner information

-

Assessed value

-

Market value

-

Exemptions status

-

Tax history linked to Port St Lucie Property Tax search

-

Official documents from St Lucie County official records

Step 3 – Verify Tax Payment Status

To confirm payment history, visit the St Lucie County Tax Collector portal. This ensures you are reviewing current St Lucie County Property Tax obligations.

Comparison with Martin County Property Appraiser

Compared to Martin County property appraiser systems, St Lucie county property search offers:

-

More refined name filtering

-

Faster address-based lookup

-

Direct integration with tax payment portals

-

Simplified navigation

Customer Testimonial Highlights

Homebuyers often say that combining St Lucie county property search with St Lucie County official records prevented unexpected liens during transactions.

Before signing any real estate contract, complete a St Lucie county property search and verify St Lucie County Property Tax records for full transparency.

Reply “NEXT” for Section 3 focusing on Port St Lucie property search by name with deeper comparison analysis.

Port St Lucie Property Search by Name

Why Use Name-Based Searches

When exact property addresses are unknown, a Port St Lucie property search by name is extremely useful. This method allows buyers, sellers, and researchers to locate property ownership records, check St Lucie County Property Tax obligations, and verify historical ownership using the property owner’s full name.

How to Conduct a Name-Based Search

Follow these steps for accurate results:

-

Visit the official St Lucie County property appraiser portal

-

Enter the property owner’s full name

-

Filter results by city or subdivision if needed

-

Review parcel numbers, addresses, and ownership history

-

Access corresponding St Lucie County official records for deeds and liens

This approach is especially helpful when multiple properties are owned by the same individual, or when performing research on inherited or estate properties.

Comparison with Address-Based Search

| Feature | Name-Based Search | Address-Based Search |

|---|---|---|

| Best Use | Unknown property addresses | Exact property location |

| Accuracy | Medium | High |

| Speed | Slower if common names | Faster |

| Data Access | Ownership history, parcels | Full property details including taxes |

While St Lucie County property search by Address provides more detailed information, name-based searches offer flexibility for initial research.

Customer Testimonial Highlights

Many users report that Port St Lucie property search by name helped uncover overlooked properties in investment portfolios, making tax tracking easier.

Pros and Cons

Pros

-

Easy initial search for unknown addresses

-

Access multiple properties by the same owner

-

Helpful for estate planning or research

Cons

-

Common names may yield too many results

-

May require follow-up searches by parcel number

-

Less precise than address-based searches

Start your Port St Lucie property search by name today to ensure you have accurate ownership and tax information before making property decisions.

St Lucie County Property Search by Address

Importance of Address-Based Searches

A St Lucie County property search by Address is the most accurate method to access property details. Whether you are buying a new home, checking tax obligations, or conducting due diligence for investment, searching by address ensures precise results, including ownership history, assessed and market value, and St Lucie County Property Tax records.

Step-by-Step Address-Based Search

-

Visit the St Lucie County property appraiser website.

-

Enter the full property address, including street number, city, and zip code.

-

Review search results:

-

Parcel identification

-

Owner information

-

Assessed value and market value

-

Exemptions status

-

Port St Lucie Property Tax history

-

-

Access linked St Lucie County official records for deeds, liens, and mortgage history.

This method reduces errors common in name-based searches and is ideal for verifying specific properties.

Comparison with Name-Based Search

| Feature | Address-Based Search | Name-Based Search |

|---|---|---|

| Accuracy | High | Medium |

| Ease of Use | Straightforward | Requires filters |

| Best For | Specific properties | Unknown or multiple properties |

| Tax Details | Direct link to St Lucie County Property Tax | Requires additional lookup |

Address-based searches are faster and more reliable, particularly for legal and financial transactions.

Customer Testimonial Highlights

Users report that St Lucie County property search by Address prevented mistakes during real estate closings, as all ownership and tax details were verified beforehand.

Pros and Cons

Pros

-

Highly accurate results

-

Immediate access to tax and ownership history

-

Reduces risk during property transactions

Cons

-

Requires complete property address

-

Cannot find properties with partial information

Perform your St Lucie County property search by Address today to confirm ownership, verify taxes, and secure a smooth property transaction.

Port St Lucie Property Tax Search Explained

Understanding Property Taxes in Port St Lucie

A Port St Lucie Property Tax search is essential for homeowners, investors, and buyers to stay informed about tax liabilities. Property taxes in St Lucie County are calculated based on assessed property value, exemptions, and millage rates set by local authorities. Accessing tax records ensures transparency and prevents surprises during property transactions.

How to Perform a Property Tax Search

-

Visit the official St Lucie County Tax Collector website.

-

Enter the property address, owner name, or parcel number.

-

Review the property tax details, including:

-

Current tax balance

-

Payment history

-

Delinquent taxes, if any

-

Exemptions applied

-

-

Download or print the tax statement for your records.

Comparison with Martin County Property Appraiser

| Feature | St Lucie County | Martin County |

|---|---|---|

| Online Tax Lookup | Available | Partial |

| Payment Portal | Direct integration | Separate system |

| Ease of Use | High | Medium |

| Historical Records | Full access | Limited |

St Lucie County’s system provides an integrated portal for both property search and tax records, making it more user-friendly than Martin County.

Customer Testimonial Highlights

Residents report that performing a Port St Lucie Property Tax search online saved them time, prevented late fees, and clarified exemption eligibility.

Pros and Cons

Pros

-

Easy online access to current and past tax records

-

Helps in planning property purchases or sales

-

Reduces risk of unpaid taxes

Cons

-

Requires accurate property details for search

-

Some historical records may need additional requests

Check your Port St Lucie Property Tax search today to ensure your payments are up to date and to plan for future property investments.

Role of St Lucie County Tax Collector

Responsibilities of the Tax Collector

The St Lucie County Tax Collector plays a vital role in managing property taxes, vehicle registrations, and other local revenue collections. For property owners, the office ensures that all St Lucie County Property Tax payments are processed accurately and on time. They also provide access to payment history and assist with exemptions, making it easier to stay compliant.

Key Services Offered

-

Accepting property tax payments online and in person

-

Providing detailed tax statements for Port St Lucie Property Tax search

-

Assisting with homestead, senior, and veteran exemptions

-

Collecting delinquent taxes and offering payment plans

-

Providing certified tax receipts for official purposes

By centralizing these services, the Tax Collector ensures transparency and convenience for property owners.

Comparison with Property Appraiser

| Feature | Tax Collector | Property Appraiser |

|---|---|---|

| Primary Role | Collect taxes and manage payments | Assess property values |

| Online Access | Payment and history records | Ownership and value data |

| Exemption Assistance | Yes | No |

| User-Friendliness | High | Medium |

While the Martin County property appraiser provides ownership and valuation details, the St Lucie County Tax Collector focuses on tax management and customer service.

Customer Testimonial Highlights

Many residents say that the St Lucie County Tax Collector’s online system streamlined their tax payments and clarified exemption eligibility, reducing stress during the tax season.

Pros and Cons

Pros

-

Efficient online portal for payments and records

-

Clear guidance on exemptions

-

Immediate verification of paid taxes

Cons

-

Some historical records may require office visits

-

Online portal requires accurate property details

Visit the St Lucie County Tax Collector website today to manage your St Lucie County Property Tax payments, verify your records, and check eligibility for exemptions.

Comparison: Martin County Property Appraiser vs St Lucie County

Overview of Both Counties

Understanding the differences between the Martin County property appraiser and St Lucie County property search systems is important for property investors, buyers, and researchers. While both counties provide public access to property records, their tools, usability, and integration with tax systems vary.

Key Differences

| Feature | St Lucie County | Martin County |

|---|---|---|

| Online Property Search | Yes, detailed by name or address | Yes, limited filters |

| Tax Integration | Full integration with Port St Lucie Property Tax search | Separate tax system |

| Official Records Access | Deeds, liens, mortgages | Deeds and basic ownership |

| User Experience | Simple, intuitive portal | Slightly complex |

| Historical Data | Extensive, easy to download | Limited |

St Lucie County’s system is more user-friendly, providing both ownership and tax details in one portal, whereas Martin County property appraiser tools may require additional searches.

Customer Testimonial Highlights

Property buyers who navigated both systems report that St Lucie County property search offered a smoother experience and quicker access to St Lucie County official records, while Martin County required multiple steps to verify ownership and taxes.

Pros and Cons

Pros of St Lucie County Property Search

-

Integrated tax and ownership records

-

Faster search filters

-

Comprehensive historical data

Cons

-

Requires internet access for online tools

-

Slight learning curve for first-time users

Pros of Martin County Property Appraiser

-

Access to basic ownership and parcel info

-

Reliable data for local properties

Cons

-

Limited integration with tax records

-

Less intuitive interface

For a seamless property verification process, use St Lucie County property search and check Port St Lucie Property Tax search for accurate tax and ownership records.

Accessing St Lucie County Official Records

What Are Official Records?

St Lucie County official records include legal documents related to property ownership, liens, mortgages, and transfers. Accessing these records is crucial for buyers, investors, and property owners to verify property history, prevent disputes, and confirm St Lucie County Property Tax payments.

How to Access Official Records

-

Visit the St Lucie County official records portal.

-

Search using:

-

Owner name

-

Property address

-

Parcel ID

-

-

Review available documents such as:

-

Deeds

-

Liens

-

Mortgages

-

Easements

-

-

Download or request certified copies if required for legal purposes.

This access ensures that all property transactions are backed by verified records, protecting both buyers and sellers.

Comparison With Martin County

| Feature | St Lucie County | Martin County |

|---|---|---|

| Document Types | Deeds, liens, mortgages, easements | Deeds, liens, limited mortgages |

| Online Access | Full download option | Partial, some require office visit |

| Integration | Linked to tax and property search | Separate system |

St Lucie County provides more comprehensive records with easier online access compared to Martin County property appraiser records.

Customer Testimonial Highlights

Users have praised St Lucie County official records for helping them verify ownership and avoid legal disputes during property purchases. Many investors rely on these records to research historical ownership and tax compliance.

Pros and Cons

Pros

-

Comprehensive access to property documents

-

Easy download of records online

-

Linked with property and tax search for convenience

Cons

-

Some certified copies require in-person request

-

Searching by common names may yield multiple results

Access St Lucie County official records today to verify property ownership, check St Lucie County Property Tax payments, and make informed property decisions.

Property Tax Exemptions in St Lucie County

Understanding Property Tax Exemptions

St Lucie County offers several property tax exemptions to reduce the tax burden for eligible residents. Knowing these exemptions helps homeowners save money and ensures accurate reporting when performing a St Lucie county property search or a Port St Lucie Property Tax search.

Common Exemptions

-

Homestead Exemption: Reduces taxable value for primary residences

-

Senior Citizen Exemption: Additional savings for residents over a certain age

-

Veteran Exemption: Benefits for qualified veterans

-

Disability Exemption: Reduces taxes for permanently disabled residents

-

Agricultural Classification: Lowers taxes for qualifying farmland

Each exemption requires proper application through the St Lucie County property appraiser’s office and may have specific eligibility criteria.

Comparison with Martin County

| Feature | St Lucie County | Martin County |

|---|---|---|

| Homestead Exemption | Available, online application | Available, office application |

| Senior/Veteran | Online forms supported | Manual forms, slower process |

| Agricultural Classification | Full support | Limited support |

St Lucie County makes it easier to apply for exemptions online compared to Martin County property appraiser systems.

Customer Testimonial Highlights

Many residents report that claiming a homestead or senior exemption through St Lucie County saved hundreds of dollars annually on St Lucie County Property Tax, simplifying budgeting for homeowners.

Pros and Cons

Pros

-

Significant tax savings

-

Online application process

-

Reduces overall property tax liability

Cons

-

Requires eligibility verification

-

Some forms need supporting documentation

-

Missing deadlines may result in denial

Check your eligibility and apply for St Lucie County property tax exemptions today to reduce your tax bill and ensure accurate records during property searches.

Common Issues & Troubleshooting Property Searches

Challenges in St Lucie County Property Search

While the St Lucie county property search system is designed for public access, users sometimes encounter issues. These challenges can delay research, affect property decisions, or cause confusion during a Port St Lucie property search by name or St Lucie County property search by Address.

Common Problems

-

Name spelling errors leading to incomplete search results

-

Incorrect or incomplete property addresses

-

Multiple properties owned by the same person

-

Website downtime or slow load times

-

Missing or outdated St Lucie County official records

Troubleshooting Tips

-

Double-check owner names and addresses for accuracy

-

Use parcel ID whenever possible for precise results

-

Cross-reference with St Lucie County Tax Collector for tax verification

-

Contact the St Lucie County property appraiser office for missing records

-

Try searches during non-peak hours to avoid website lag

Comparison with Martin County Property Appraiser

| Feature | St Lucie County | Martin County |

|---|---|---|

| Search Reliability | High with proper details | Moderate, may require manual follow-up |

| Technical Support | Responsive | Limited |

| Integration with Tax Records | Yes | Partial |

St Lucie County provides better troubleshooting support and integrated tax data compared to Martin County.

Customer Testimonial Highlights

Homeowners say that troubleshooting issues with St Lucie County property search was easier because support staff guided them through corrections and cross-referenced Port St Lucie Property Tax search results.

Pros and Cons

Pros

-

Helpful support for common issues

-

Detailed online guides and FAQs

-

Integrated search with tax and ownership records

Cons

-

Requires patience for first-time users

-

Occasional website delays

-

Some historical records may need office visits

If you encounter any problems, follow these tips and complete your St Lucie county property search today to verify ownership, tax records, and official documents.

Benefits of Using Online Property Search Tools

Why Online Property Search Matters

Using online tools for a St Lucie county property search or a Port St Lucie property search by name simplifies access to property information. Homeowners, buyers, and investors can quickly verify ownership, check St Lucie County Property Tax records, and review historical data from the comfort of their home.

Key Advantages

-

Instant access to ownership and tax records

-

Ability to download St Lucie County official records like deeds, liens, and mortgages

-

Compare properties in Port St Lucie or nearby areas efficiently

-

Avoid travel to offices and long wait times

-

Track multiple properties for investment planning

Comparison with Martin County Property Appraiser

| Feature | St Lucie County | Martin County |

|---|---|---|

| Online Access | Full portal for ownership, tax, and official records | Partial, often requires office visits |

| Ease of Use | High | Moderate |

| Historical Data | Downloadable, detailed | Limited |

| Integrated Tax Lookup | Yes | No |

The online tools provided by St Lucie County are more comprehensive and integrated, allowing faster verification and better decision-making than Martin County property appraiser systems.

Customer Testimonial Highlights

Investors and homeowners often note that using the online St Lucie county property search saved them hours of manual work and helped prevent mistakes in transactions by cross-referencing tax data and official records.

Pros and Cons

Pros

-

Quick and convenient

-

Access multiple data points in one portal

-

Useful for buyers, sellers, and investors

Cons

-

Requires reliable internet

-

First-time users may need guidance navigating tools

Take advantage of the St Lucie county property search online tools today to verify property ownership, review St Lucie County Property Tax records, and make informed real estate decisions.

Conclusion and Final Recommendations

Key Takeaways

A St Lucie county property search is essential for anyone involved in real estate, from homeowners to investors. By utilizing both name-based and address-based searches, users can access detailed ownership records, check Port St Lucie Property Tax obligations, and review historical data through St Lucie County official records.

Using the St Lucie County property appraiser portal offers several advantages over neighboring counties like Martin County:

-

Integrated access to ownership and tax information

-

User-friendly online tools

-

Comprehensive historical records and official documents

Final Recommendations

-

Always verify property details before purchasing or refinancing

-

Use multiple search methods (name, address, parcel number) for accuracy

-

Check for applicable St Lucie County property tax exemptions

-

Cross-reference results with the St Lucie County Tax Collector portal

-

Download or request certified copies of official records for legal purposes

Pros and Cons Summary

Pros

-

Full transparency of property ownership and tax obligations

-

Saves time and prevents errors

-

Supports investment decisions

Cons

-

Requires accurate details for efficient searches

-

Some historical documents may need in-person requests

Start your St Lucie county property search today. Verify ownership, review St Lucie County Property Tax records, and ensure your property transactions are secure and informed.

FAQs

1. How do I perform a St Lucie county property search?

You can search by owner name, property address, or parcel ID on the official St Lucie County property appraiser website.

2. Can I check Port St Lucie property tax online?

Yes, the St Lucie County Tax Collector website allows online verification of Port St Lucie Property Tax payments.

3. What is the difference between St Lucie County Tax Collector and property appraiser?

The Tax Collector manages payments and exemptions, while the property appraiser assesses property values and maintains ownership records.

4. How do I search St Lucie County property by name?

Use the full owner name on the property appraiser portal and filter results by city or subdivision for accuracy.

5. How do I access St Lucie County official records?

Official records like deeds, liens, and mortgages are accessible online through the St Lucie County records portal, searchable by name, address, or parcel ID.

6. Are there property tax exemptions in St Lucie County?

Yes, including homestead, senior, veteran, disability, and agricultural exemptions, applied through the property appraiser’s office.

7. How does St Lucie County property search compare to Martin County?

St Lucie County offers more integrated online tools, easier access to tax data, and comprehensive historical records compared to Martin County property appraiser systems.

Author

-

Hello and welcome! I’m Jessica E. Miranda], and I have the honor of serving as the Hamilton County Auditor. My mission, along with that of my dedicated team, is to ensure that property values are assessed fairly, tax dollars are managed responsibly, and public records remain transparent and easily accessible to every resident in Hamilton County see more