Searching for property information can be confusing, especially when multiple properties share similar addresses or when street names change over time. That’s where parcel numbers become invaluable they provide a unique, permanent identifier for every piece of real estate, making property searches faster, more accurate, and more reliable. Whether you’re a prospective home buyer researching properties, a real estate investor analyzing potential deals, a homeowner verifying tax assessments, or a researcher conducting due diligence,

understanding how to search by parcel number unlocks access to comprehensive public records instantly. This complete guide walks you through everything you need to know: what parcel numbers are, where to find them, how to use them for property searches, what information you can access, and how to troubleshoot common problems. By the end of this guide, you’ll be confidently navigating county property databases, accessing ownership details, tax information, property valuations, and building specifications with precision and ease.

How to Property Search by Parcel Number

Property records serve as the official documentation of real estate ownership, boundaries, valuations, and tax obligations within a jurisdiction. These public records are maintained by county governments and provide transparency in property transactions, tax assessments, and land use planning. Accessing these records helps buyers verify ownership, investors evaluate properties, and homeowners confirm tax assessments.

The parcel number plays a central role in property identification systems nationwide. Unlike street addresses that can change, become duplicated, or cause confusion in rural areas, parcel numbers remain constant and unique to each property. Online property search tools have revolutionized access to these records, eliminating the need for in-person courthouse visits and enabling instant access to comprehensive property data. The digitization of property records means anyone can research ownership history, assess property values, verify tax payments, review building permits, and access legal descriptions—all from their computer or smartphone. This accessibility benefits homeowners, real estate professionals, title companies, appraisers, attorneys, and anyone with a legitimate interest in property information.

What Is a Parcel Number?

A parcel number is a unique identifier assigned by county tax assessors or auditors to every individual piece of real property within their jurisdiction. This alphanumeric code serves as the property’s permanent identification in government records, similar to how a Social Security number identifies individuals or a VIN identifies vehicles. The parcel number remains attached to the land regardless of ownership changes, address modifications, or property subdivisions.

County records rely heavily on parcel numbers for organizing property data, tracking ownership transfers, calculating tax assessments, maintaining mapping systems, and managing land use planning. Tax collectors, assessors, appraisers, surveyors, and planning departments all reference parcel numbers as the primary key to accessing property information. The format varies by county

some use purely numeric systems (like 123-45-678), others combine numbers and letters (R12-34-ABC), and some include additional codes indicating tax districts or geographic zones. Despite format variations, each parcel number is unique within its county, ensuring no two properties share the same identifier. This uniqueness makes parcel numbers the most reliable method for property identification, especially when researching properties in areas with confusing addressing systems, unnamed roads, or recently developed subdivisions

.

Parcel Number vs Property Address

Key Differences:

| Aspect | Parcel Number | Property Address |

|---|---|---|

| Uniqueness | Always unique within county | Can have duplicates or variations |

| Permanence | Rarely changes | Can change with street renaming |

| Accuracy | Pinpoints exact property boundaries | May be ambiguous in rural areas |

| Format | Standardized alphanumeric code | Text-based, varies by location |

| Rural Properties | Always assigned | May not exist or be unclear |

| Legal Documents | Used in deeds and tax records | Used for mailing and navigation |

When Parcel Numbers Are More Accurate:

Parcel numbers prove more accurate when multiple properties exist on the same street with similar addresses, rural properties lack formal street addresses, properties have been subdivided or merged, street names have changed over time, searching condominiums or multi-unit buildings where unit numbers cause confusion, verifying exact legal boundaries for survey purposes, researching vacant land without structures, or accessing historical records predating current addressing systems. For example, “123 Main Street” might refer to multiple units in a building, but parcel number 45-678-901 identifies one specific unit precisely.

How to Find a Parcel Number

Locating your parcel number is straight forward if you know where to look. County governments include this identifier on multiple official documents since it’s essential for property administration and taxation. The easiest methods include checking documents you already possess or accessing online county databases.

Primary Sources for Finding Parcel Numbers:

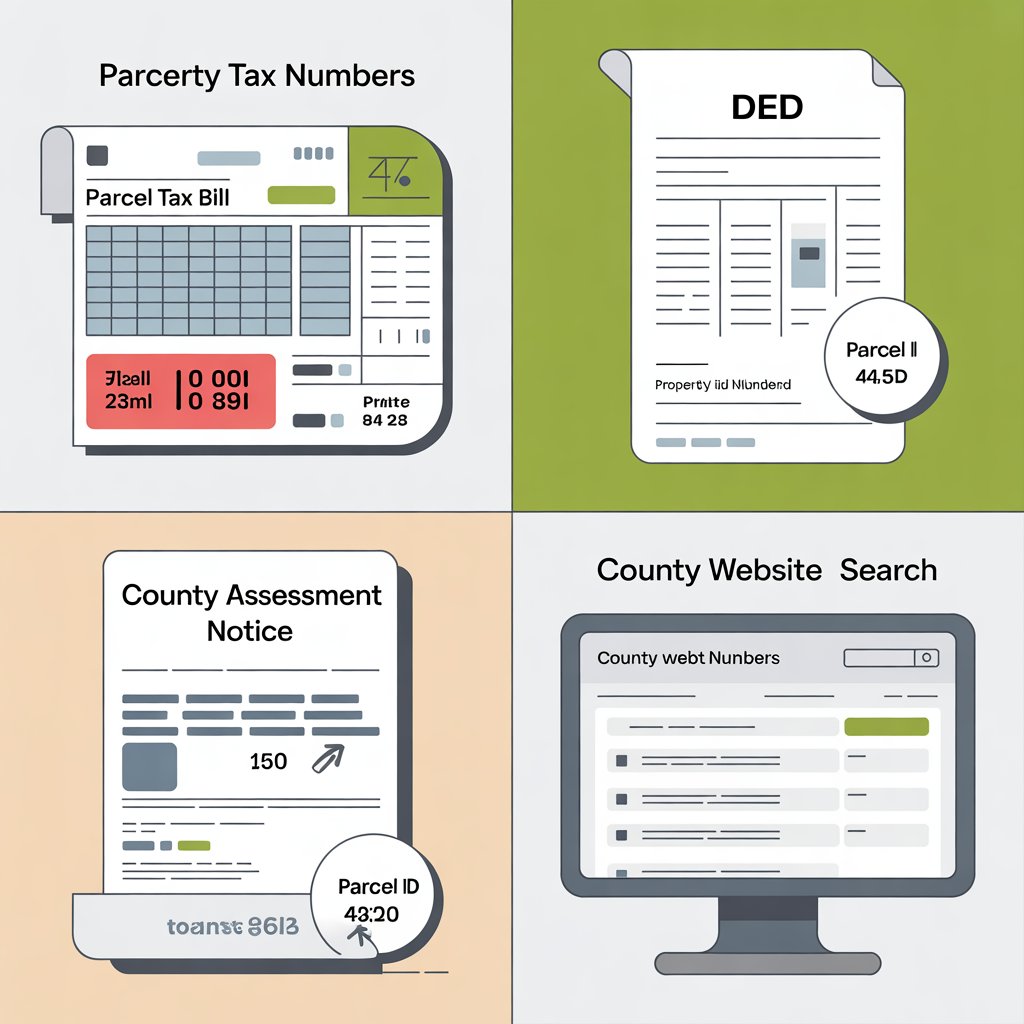

1. Property Tax Bill: Your annual or semi-annual property tax statement prominently displays the parcel number, usually near the top of the document alongside the property address. This is typically labeled as “Parcel Number,” “Parcel ID,” “Tax ID Number,” or “Assessor’s Parcel Number (APN).” Tax bills are the most accessible source since property owners receive them regularly.

2. Deed or Title Documents: When you purchase property, your deed and title documents include the parcel number as part of the legal description. These documents are recorded with the county recorder’s office and contain the complete legal identification of your property, including lot numbers, subdivision names, and the parcel identifier.

3. Assessment Notice: Annual property assessment notices sent by county assessors include parcel numbers. These notices inform property owners of their property’s assessed value for tax purposes and always reference the parcel number for identification.

4. County Auditor or Assessor Website: Most counties provide online databases where you can search by address to retrieve the parcel number. Visit your county auditor’s or assessor’s official website, enter your property address in their search tool, and the results will display the associated parcel number along with basic property information.

5. GIS Mapping Tools: Many counties offer Geographic Information System (GIS) mapping portals where you can locate properties visually on interactive maps. Click on a property, and the system displays its parcel number along with boundaries, dimensions, and other spatial data.

6. County Offices In-Person: If online resources are unavailable or confusing, visit your county auditor’s, assessor’s, or recorder’s office in person. Staff can look up parcel numbers using your property address and provide you with the information immediately.

Step-by-Step Guide to Property Search by Parcel Number

Conducting a property search using a parcel number is a straightforward process once you understand the basic steps and know where to access county databases. Most counties have modernized their records systems with user-friendly online portals that provide 24/7 access to property information.

Detailed Search Process:

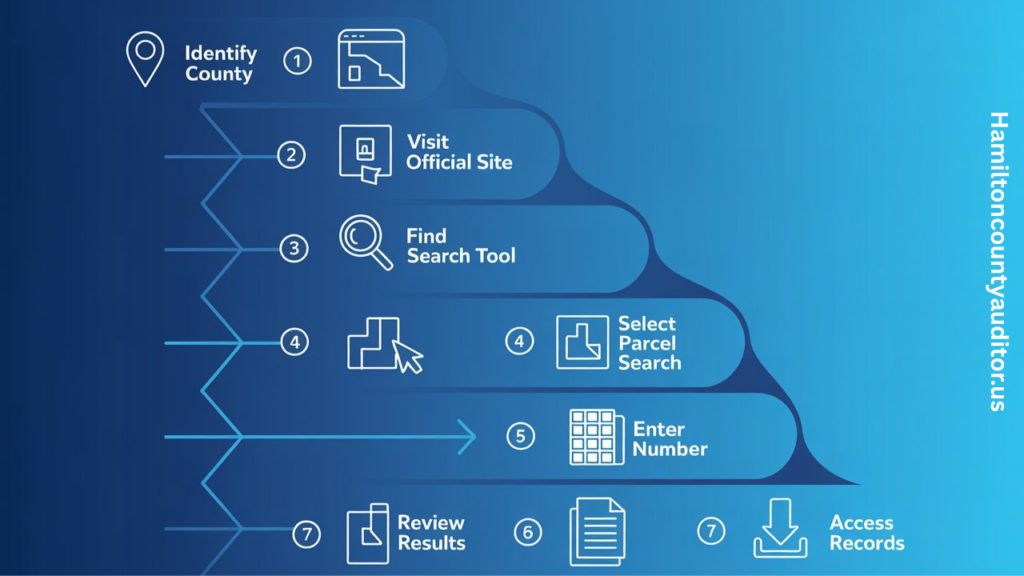

Step 1: Identify Your County Determine which county the property is located in, as property records are maintained at the county level. Each county operates its own database system, so you must access the correct county’s website.

Step 2: Navigate to Official County Website Search for “[Hamilton county] property search” or “[Hamilton county] auditor” in your web browser. Look for official government websites (ending in .gov) to ensure you’re accessing authentic records. Common departments that maintain these databases include:

- County Auditor’s Office

- County Assessor’s Office

- County Treasurer’s Office

- County Recorder’s Office

Step 3: Locate the Property Search Tool On the county website, find links labeled “Property Search,” “Parcel Search,” “Real Estate Search,” “Property Records,” or “Tax Records.” These may be on the homepage or under specific department sections.

Step 4: Select Search by Parcel Number Most property search portals offer multiple search options (address, owner name, parcel number). Select “Search by Parcel Number” or “Parcel ID Search” from the available options.

Step 5: Enter Parcel Number in Correct Format Input the parcel number exactly as it appears on your tax bill or deed. Pay attention to:

- Hyphens or dashes in specific positions

- Spaces between segments

- Leading zeros that must be included

- Letter capitalization if alphanumeric

For example, if the format is 123-45-678-000, don’t enter it as 1234567800.

Step 6: Review Search Results After submitting, the system displays detailed property information. Results typically appear within seconds and include comprehensive data about the property’s characteristics, ownership, and valuation.

Step 7: Access Additional Records Many county systems allow you to click through to related records such as:

- Ownership transfer history

- Building permits

- Survey maps

- Sales history

- Tax payment records

- Property photographs

Information You Can View Using a Parcel Number

Comprehensive Property Data Available:

Owner Information: Current owner’s full legal name, mailing address for tax correspondence, ownership type (individual, trust, LLC, corporation), date ownership was acquired, and previous owners in some counties.

Property Valuation: Market value (estimated sale price), assessed value for tax calculation purposes, land value separate from improvements, building value separate from land, total taxable value, recent appraisal dates, and historical value trends.

Land and Building Details: Total acreage or square footage of land, lot dimensions and property boundaries, building square footage (heated/finished space), year built or construction date, number of stories, bedrooms and bathrooms, architectural style and building type, construction materials, foundation type, roof type and age, garage or carport details, swimming pools, decks, or other features, zoning classification, and land use designation.

Tax Status: Current year property taxes owed, annual tax amount, payment status (paid, unpaid, delinquent), tax payment history, tax district information, special assessments or liens, tax exemptions applied (homestead, senior, veteran), and next payment due date.

Additional Records: Legal property description, subdivision name and lot number, sales history with dates and prices, property transfers and deed references, building permits issued, zoning variances or exceptions, flood zone designation, and school district assignment.

Benefits of Property Search by Parcel Number

Using parcel numbers for property searches offers distinct advantages over other search methods, particularly when accuracy and efficiency matter most. Real estate professionals, title companies, appraisers, and property researchers prefer parcel number searches for their reliability and precision.

Key Advantages:

1. Guaranteed Accurate Results: Parcel numbers eliminate ambiguity entirely. Unlike address searches that might return multiple similar properties or confuse unit numbers, a parcel number search returns exactly one property—the correct one. This precision is crucial for legal transactions, title searches, and property valuations where accuracy isn’t negotiable.

2. Lightning-Fast Access to Public Records: Parcel number searches typically return results within seconds, bypassing the need to sort through similar addresses or verify locations. The direct database query pulls comprehensive information immediately, saving valuable time for professionals conducting multiple searches daily.

3. Complete Elimination of Address Confusion: Properties without formal addresses, rural lands, recently subdivided lots, properties with changed street names, buildings with multiple units sharing addresses, or areas with duplicate street names across different subdivisions—all these scenarios create address-based search problems. Parcel numbers sidestep these issues entirely.

4. Access to Historical Records: Even if property addresses have changed over decades, the parcel number often remains constant, allowing researchers to trace property history through multiple ownership transfers, address changes, and municipal reorganizations.

5. Legal and Official Documentation: Parcel numbers appear on legal documents, making them the preferred identifier for attorneys, title companies, surveyors, and anyone conducting official property research or transactions.

6. Rural and Undeveloped Land: Properties without street addresses common for agricultural land, timber tracts, vacant lots, and undeveloped acreage can only be reliably searched using parcel numbers or legal descriptions.

Common Problems While Searching by Parcel Number

Despite the reliability of parcel number searches, users occasionally encounter obstacles that prevent successful results. Understanding these common issues and their solutions helps you troubleshoot problems quickly and complete your research efficiently.

Frequent Search Challenges:

1. Incorrect or Incomplete Parcel Number: The most common problem is data entry errors. Users might:

- Omit leading zeros (entering 12345 instead of 012345)

- Forget hyphens or insert them incorrectly (123-456 vs 12-34-56)

- Transpose digits (123-45-678 becomes 123-54-678)

- Include extra spaces or remove required spaces

- Use uppercase when lowercase is required, or vice versa

Solution: Double-check the parcel number against your official tax bill or deed. Copy and paste if possible to avoid transcription errors. If the format is unclear, try variations with different hyphen placements or contact the county office for clarification.

2. Old or Merged Parcels: Property subdivisions and lot combinations change parcel numbers. When owners:

- Split one large parcel into multiple smaller lots

- Combine adjacent lots into a single property

- Participate in lot line adjustments

- Experience boundary corrections

The original parcel number becomes obsolete, replaced with new identifiers. Historical searches using old parcel numbers fail because the current database doesn’t recognize the outdated number.

Solution: Search by the property address first to find the current active parcel number, then use that number for detailed searches. Some county systems include cross-reference tools showing old parcel numbers and their current replacements.

3. County Mismatch Issues: Users sometimes search in the wrong county’s database when:

- Properties sit near county borders

- Mailing addresses list a different county than the property’s actual location

- Assumptions about county boundaries are incorrect

- Recent annexations changed county jurisdictions

Solution: Verify the property’s actual county location using the physical address and a county boundary map. Search in the correct county’s database. If uncertain, check adjacent counties’ databases.

4. Recently Created Parcels: Newly subdivided properties may take weeks or months to appear in online databases as county staff process surveys, update GIS systems, and assign new parcel numbers.

Solution: For very recent subdivisions, contact the county planning or assessor’s office directly. They can confirm the new parcel number even if it hasn’t appeared online yet.

5. System Formatting Requirements: Some county databases have strict formatting requirements that aren’t clearly explained on their websites, causing valid parcel numbers to be rejected.

Solution: Look for format examples on the search page, try different variations, or call the county office for proper formatting guidance.

Tips for Accurate Property Search Results

Maximizing search accuracy requires attention to detail and understanding of how county property databases function. These proven strategies help you obtain correct results on the first attempt and avoid frustrating dead ends.

Best Practices for Successful Searches:

1. Use the Exact Number from Official Documents: Always reference your property tax bill, deed, or official assessment notice when entering parcel numbers. Don’t rely on memory or handwritten notes, as small errors cause search failures. If you’re researching someone else’s property, verify the parcel number through multiple sources when possible.

2. Pay Attention to Hyphens and Spaces: County databases often require exact formatting:

- Some systems automatically insert hyphens, others require manual entry

- Extra spaces may cause rejection

- Missing spaces in required positions prevent matches

- Try both with and without hyphens if initial search fails

Example formats you might encounter:

- 123-45-678-000 (hyphens in specific positions)

- 12 34 56 789 (spaces instead of hyphens)

- 123456789000 (no separators)

- R-12-34-ABC-56 (alphanumeric with hyphens)

3. Include All Leading Zeros: Many parcel numbers begin with zeros that must be included: 012345, not 12345. Databases treat these as completely different numbers. If your search fails, check whether you’ve omitted leading zeros.

4. Verify You’re Searching the Correct County: Don’t assume—confirm the property’s actual county location. Use mapping tools or address verification services if uncertain. Properties near borders or in unincorporated areas sometimes surprise owners regarding their jurisdiction.

5. Check for Updated Records: County records undergo periodic updates. If searching for recently transferred properties, subdivided lots, or newly constructed buildings, data may lag by weeks or months. For the most current information, call the county office to verify database update schedules.

6. Try Alternative Search Methods: If parcel number search fails, use the property address to locate the record, then verify the correct current parcel number. This cross-reference often reveals number changes you weren’t aware of.

7. Save Successful Search Results: Once you find the correct property, save or print the results page. Note the exact parcel number format that worked for future reference, especially if you’ll conduct additional searches in the same county.

8. Understand Seasonal Database Maintenance: Some counties perform system updates during specific periods (often after tax assessment cycles). Database unavailability or temporary data inconsistencies may occur during these maintenance windows.

Is Property Search by Parcel Number Free?

Property records are generally public information under state open records laws, and most counties provide free online access to basic property data. The principle of government transparency requires that certain records remain accessible to the public without fees.

What’s Typically Free:

- Viewing property ownership information

- Accessing assessed values and tax amounts

- Reviewing basic property characteristics (size, age, bedrooms)

- Checking tax payment status

- Seeing sales history

- Viewing parcel maps

What May Require Fees:

- Certified copies of official documents

- Detailed property reports or data exports

- Historical deed copies or recorded documents

- Survey plats or engineering drawings

- Premium data services with enhanced features

County policies vary significantly. Some counties charge nothing for any online access, while others implement fees for detailed reports or document copies. Third-party property information websites often charge subscription fees or per-report charges for aggregated data from multiple counties, enhanced analytics, or user-friendly interfaces.

For basic property searches by parcel number on official county government websites, expect free access to fundamental public record information. If you need certified copies for legal purposes, closing transactions, or official filings, anticipate fees typically ranging from $1 to $25 per document, depending on the county and document type.

Important Disclaimer

Critical User Notice:

This guide provides general educational information about property searches and parcel number usage. It is not affiliated with, endorsed by, or operated by any government agency, county office, or official property record system.

Information Accuracy Limitations: Property data accessed through searches serves informational and research purposes only. While county databases generally contain accurate information, errors can occur due to:

- Data entry mistakes

- Pending updates not yet processed

- System synchronization delays

- Historical record inconsistencies

- Incomplete information transfers during system migrations

Not Suitable for Legal or Certified Use: Information obtained through parcel number searches should not be relied upon for:

- Legal proceedings or court filings

- Real estate closings or title transfers

- Loan applications or mortgage underwriting

- Official tax appeals or assessments

- Property boundary disputes

- Zoning compliance verification

For Official or Legal Purposes: Always contact the appropriate county office directly:

- County Auditor for tax assessments and valuations

- County Recorder for deed copies and official documents

- County Assessor for property characteristics and appeals

- County Treasurer for certified tax payment records

- County Planning for zoning and land use verification

Request certified copies bearing official seals and signatures when documents will be submitted to courts, government agencies, financial institutions, or used in legal transactions.

Professional Advice Recommended: For important property decisions, consult qualified professionals:

- Real estate attorneys for legal questions

- Licensed appraisers for property valuations

- Title companies for ownership verification

- Surveyors for boundary determinations

- Real estate agents for market analysis

This disclaimer protects users from relying on potentially outdated or incorrect information for critical decisions while encouraging proper verification through official channels.

Frequently Asked Questions (FAQs)

Property parcel number searches raise common questions about accessibility, accuracy, and proper usage. These concise answers address the most frequent user inquiries to help you navigate property search tools effectively and understand what to expect when researching real estate records online.

H3: Can I search property records online using a parcel number?

Yes. Most counties provide free online property search tools through their auditor, assessor, or treasurer websites. Visit your county’s official government site, find the property search portal, enter your parcel number in the correct format, and view results instantly showing ownership, taxes, and property details.

H3: Is a parcel number the same as a property ID?

Yes. Parcel numbers and property IDs are the same thing with different names. Counties may call them Assessor’s Parcel Number (APN), Tax ID, PIN, or Account Number, but all serve one purpose: uniquely identifying a specific property within county records.

H3: How accurate is parcel number search?

Highly accurate. Each parcel number identifies exactly one property, eliminating confusion from similar addresses or duplicate street names. Accuracy depends on entering the correct number format. For legal purposes, always verify information with certified copies from county offices.

H3: Can parcel numbers change over time?

Yes, but rarely. Parcel numbers change when properties are subdivided into smaller lots, multiple parcels are combined, lot lines are adjusted, or counties reorganize numbering systems. Most established residential properties keep the same number indefinitely. County records maintain cross-references to old numbers.

H3: What should I do if my parcel number does not work?

First, verify you’re searching the correct county. Double-check the format including hyphens, spaces, and leading zeros. Try format variations or search by address to find the current parcel number. If problems persist, contact your county auditor’s office for assistance.

H3: Where can I find my parcel number?

Check your property tax bill (most common source), deed or title documents, annual assessment notice, county auditor’s website by searching your address, or contact your county office directly for assistance.

H3: Is property search by parcel number free?

Most counties offer free online access to basic property information including ownership, assessed values, and tax status. Some may charge fees for certified copies, detailed reports, or official documents needed for legal purposes.

H3: What information can I get from a parcel number search?

You can view owner names, property values, land and building details, tax amounts and payment status, sales history, legal descriptions, zoning information, and building permits. Available details vary by county.

H3: Can I search properties in other counties?

Yes, but each county maintains its own separate database. You must access each county’s individual website to search their properties. There’s no unified national database for property records.

H3: How do I know if a parcel number is correct?

Verify it against official documents like tax bills or deeds. If search results show the expected property address and owner name, your number is correct. Mismatched information indicates an incorrect number.

Conclusion (100 words)

Property search by parcel number provides the most accurate and efficient method for accessing real estate records. This unique identifier eliminates confusion associated with address-based searches, especially for rural properties or areas with duplicate street names. By using exact parcel numbers from official documents and following proper formatting requirements, you can confidently retrieve ownership information, tax assessments, property valuations, and building characteristics. While online searches serve excellent research purposes, always obtain certified copies from official county offices for legal transactions or court proceedings. Master parcel number searches to access vital property information instantly and conduct thorough real estate research with confidence.